change in net operating working capital formula

Broker-dealers are companies that trade securities for customers ie brokers and for their own accounts ie dealers. Net Operating Income Approach to capital structure believes that the value of a firm is not affected by the change of debt component in the capital structure.

Working Capital Turnover Ratio Formula Calculator Excel Template

It assumes that the benefit that a firm derives by infusion of debt is negated by the simultaneous increase in the required rate of return by the equity shareholders.

. What is Change in NWC. What is Working Capital. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash.

Securities and Exchange Commission SEC in 1975 to regulate directly the ability of broker-dealers to meet their financial obligations to customers and other creditors. This means the time needed to acquire raw material manufacture goods and sell finished goods is optimum. Changes in the Net Working Capital Change in.

30000 5000 19000 44000. If the change in NWC is positive the company collects and holds onto cash earlier. On the other hand if the company is unable to produce positive working.

Positive net working capital is resultant when a company has enough current assets over its current dues. Since the change in working capital is positive you add it back to Free Cash Flow. Explanation of Working Capital Formula.

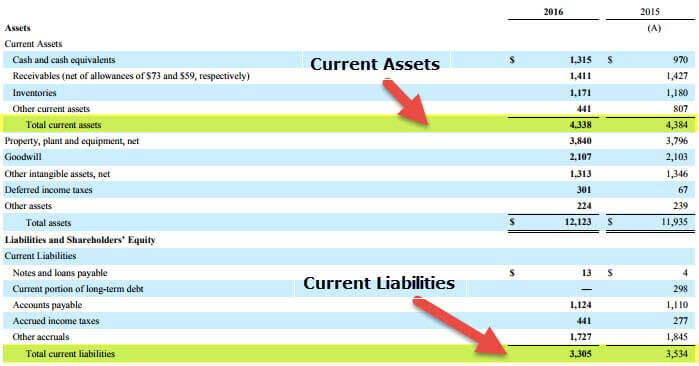

Working capital is calculated as. Current liabilities are best paid with current assets like cash cash equivalents and. The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets.

The uniform net capital rule is a rule created by the US. Net Working Capital Assumptions. Adequate Net Working Capital ensures that your business has a smooth operating cycle.

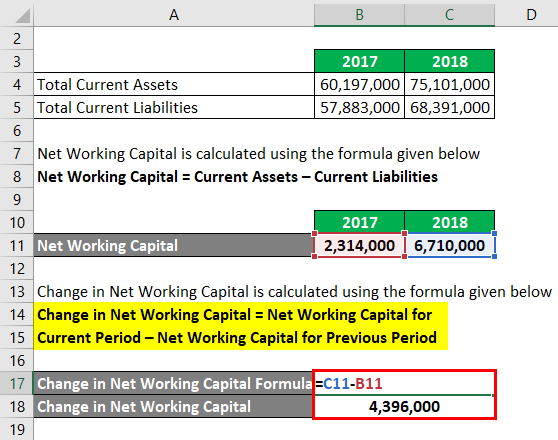

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Determine whether the cash flow will increase or decrease based on the needs of the business. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital.

This measurement is important to management vendors and general creditors because it shows the firms short-term liquidity as well as managements ability to use its assets efficiently. Calculate the change in working capital. Both refer to the difference between all current assets and all current liabilities.

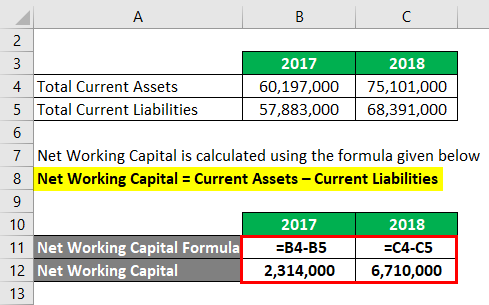

For the working capital schedule and fixed assets forecast the following assumptions will be used. A working capital formula is extensively used in a business to meet short-term financial obligations or short-term liabilities. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or.

The goal is to. So a positive change in net working capital is cash outflow. Add or subtract the amount.

Similarly change in net working capital helps us to understand the cash flow position of the company. Why Calculating Cash Flow is Important. Next well calculate the invested capital which represents the net operating assets used to generate cash flow.

One of these alternative formulas excludes cash and debt. The terms working capital and net working capital are synonymous. Working capital is a measure of both a companys efficiency and its short-term financial health.

However some analysts define net working capital more narrowly than working capital. Working Capital vs. Thats why the formula is written as - change in working capital.

Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. It comprises inventory cash. Net working capital is a liquidity calculation that measures a companys ability to pay off its current liabilities with current assets.

The working capital ratio is important to creditors because it shows the liquidity of the company. Net Working Capital Formula Current Assets Current Liabilities. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health.

Also look at working capital ratio Working Capital Ratio The working capital ratio is the ratio that helps in assessing the financial performance and the health of the company where the ratio of less than 1 indicates the probability of financial or liquidity problems in the future to the company and it is calculated by dividing the total. However if the change in NWC is negative the business model of the company might require. If a company has an operating income of 30000 5000 in taxes zero depreciation and 19000 working capital its operating cash flow is.

More Current Ratio Explained With Formula and Examples.

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Days Working Capital Formula Calculate Example Investor S Analysis

What Is Net Working Capital How To Calculate Nwc Formula

Change In Working Capital Video Tutorial W Excel Download

Operating Working Capital Owc Formula And Calculator Excel Template

Change In Working Capital Video Tutorial W Excel Download

Working Capital Ratio Analysis Example Of Working Capital Ratio

Working Capital What It Is And How To Calculate It Efficy

Is A House An Asset Or Liability Online Accounting

Net Working Capital Definition Formula How To Calculate

Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Why You Need To Know The Working Capital Formulation And Ratio India Dictionary

Change In Net Working Capital Nwc Formula And Calculator Excel Template

What Is Net Working Capital Daily Business

Change In Working Capital Video Tutorial W Excel Download