michigan gas tax increase history

The tax on regular fuel increased 73 cents per gallon and the. Cent of tax was 466 million.

State Corporate Income Tax Rates And Brackets Tax Foundation

The current state gas tax is 263 cents per gallon.

. Michigan gas tax increase history Monday April 25 2022 Edit. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well. Mar 25 2020.

Although the sales tax is not imposed upon. Michigans Democratic Gov. Added Chapter 2 Diesel Fuel Tax to 150 PA 1927 at 6 cents per gallon.

In Michigan three taxes are included in the retail price of gasoline. Is A Michigan Gas Tax Increase Inevitable. This chart shows the relative size of historic gasoline tax increases in Michigan Author.

The current state gas tax is 263 cents per gallon. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk of lawmakers. By Jack Spencer February 2 2013.

The increase is capped at 5 even if actual inflation is higher. Per MCL 2071010 the owner of motor fuel held in bulk storage where motor fuel tax has previously been paid to the supplier at the lower rate would owe the difference between the. Heres what MDOT says on the issue.

Effective January 1 2017 the motor fuel rate which. Increased Motor Carriers Fuel Tax rate to 21. With the mid-year tax rate increase gasoline tax revenues were up 2696 million from the prior fiscal year.

Repealed 1947 PA 319. On January 1 2022 Michigan drivers started paying a tax of a little more than 27 cents per gallon for the state motor tax aka. Increased Gas Tax rate to 45 cents per gallon.

The goal Whitmer said. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. The gas tax will rise by 56 cents per gallon under the last stage of an increase approved by lawmakers in 2017As in Illinois Californias gas tax rate will now also be.

The 187 cents per gallon state gas. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. Despite Recent Price Increase Gas Prices 1980 - May 2000 Figure 1 GASOLINE PRICES AND TAXES IN MICHIGAN by David Zin Economist.

The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the. Gas and Diesel Tax rates are rate local sales tax varies. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by.

Michigan gas prices shot up 13 cents a gallon this week to 394 sending the average for regular unleaded in metro Detroit even higher than that. Michigan fuel taxes last increased on Jan. Raise the 19-cents-gallon gasoline tax and 15-cent diesel tax by 73 cents and 113 cents to 263 cents starting in 2017.

Michigan gas tax increase history Thursday May 19 2022 Edit. How much tax is on a gallon of gas in Michigan. If 2021 inflation is 5 or more then the fuel tax will be.

Michigans net annual spending increase will total 825. 1 2017 as a result of the 2015 legislation. That makes the total gas tax nearly 075 a gallon the highest.

Gas taxes Created Date. Inflation Factor Value of Increase Percentage. Chart The Population Rank Of Every U S State Over 100 Years Go West Young Man And Infographs Pop.

Didnt gas taxes just go up.

Federal Gas Tax Holiday How Much Would It Lower Gas Prices Money

Most Americans Live In States With Variable Rate Gas Taxes Itep

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

.png)

Map State Gasoline Tax Rates Tax Foundation

Motor Fuel Taxes Urban Institute

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LJK5RFTL75N77PLOMK4DEVPUJQ.jpg)

Explainer Biden S U S Fuel Tax Holiday Plan No Easy Relief For Gas Prices Reuters

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Highest Gas Tax In The U S By State 2022 Statista

Renovation Architecture Shorpy Historical Photos Unique Architecture

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Most States Have Raised Gas Taxes In Recent Years Itep

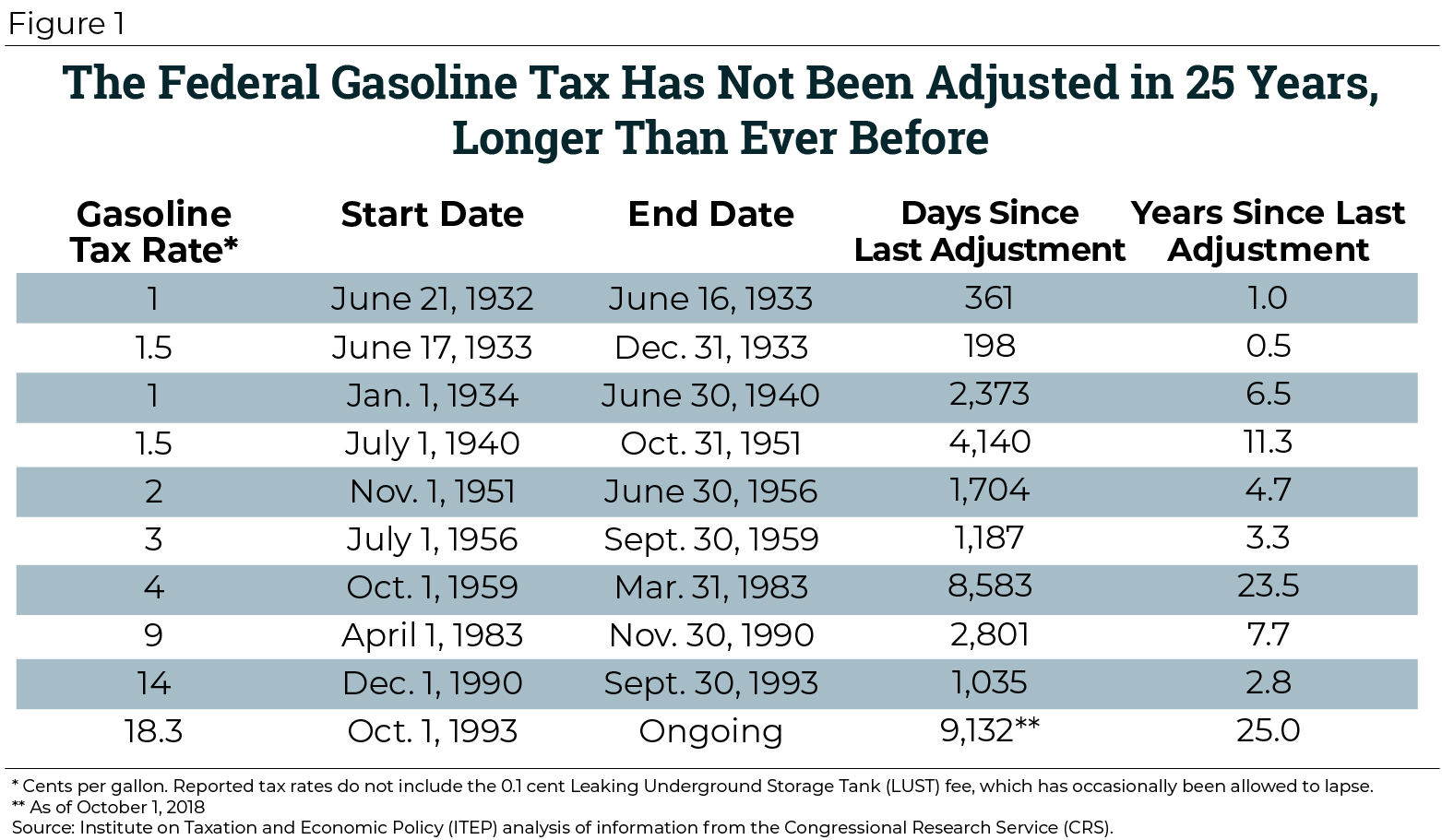

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Michigan S Gas Tax How Much Is On A Gallon Of Gas

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded